In the past few weeks I’ve had to fork out on a new boiler for one of my rental properties, get a plumber in as an emergency due to a leaky u-bend in a little BTL I own and argue with an electrician over the quality of his work in a house I am currently renovating. In the case of the latter – he’s not one of my regular ‘Power Team’ and reminds me of the reason why I usually always give work to my trusted contractors but on this occasion due to location and Covid lockdown I was forced to use someone else recommended to me. The importance of checking out contractors well and building up a power base of reliable contacts is something for another day, but for now, let’s just say it’s been frustrating and (probably) costly for me.

But anyone with a portfolio of properties – however big or small – will probably relate to these challenges as they are pretty much the run of the mill annoyances and situations to overcome in the world of being a property investor or landlord.

So it is with interest that this week I read an article based on a recent survey carried out by the investment company FJP Investment. The survey, which was taken by more than 1,000 UK-based investors, all of who had investments and savings in excess of £10,000 (excluding the value of their residential property and workplace pensions) found that 62% are concerned that the Government’s handling of the pandemic will result in a long-term recession.

As well as this, 41% of those surveyed said they were worried about the impact of the UK leaving the EU on their finances and less than half (42%) said they believed the UK would remain a global investment hub following the UK’s exit from the EU and Covid-19.

Not great.

But the survey also found that 51% believe that UK property will be a sound investment regardless of Covid-19 and the outcome of the trade negotiations between Britain and the EU. The survey also found that 40% think that house prices will increase in 2021, compared to 19% who are expecting it to decline.

Commenting on the survey, Jamie Johnson, CEO of FJP Investment, said: “The economic disruption caused by Covid-19 clearly has investors worried. With the Bank of England downgrading its latest GDP growth forecasts and announcing a further £150 billion economic stimulus, investors are concerned there is still a long way to go for the UK to overcome the pandemic-induced recession”

At the same time, a no deal Brexit is looking increasingly likely – the lack of progress between London and Brussels on Brexit negotiations has not been grabbing the headlines because of Covid but this uncertainty is making it difficult for investors to plan for the future.

Jamie Johnson goes onto say, “Despite these issues, however, our research shows that investors are still positive when it comes to property. House prices have been growing at a remarkable rate recently and many investors are confident this will continue over the course of 2021. This is important – any attempt to stimulate investment and economic growth will be boosted by a vibrant property market. As such, it is vital for the Government to implement policies that sustain this interest over the long-term.”

So others are waking up to what myself and my colleagues at Asset Academy already know – that property in the long term is where to go.

But do the clients of investment firms like FJP Investment buy property directly and get involved in the nitty gritty of negotiating with tenants, contractors, letting agents and management companies? Some of them may, but for the ‘armchair investor’ there is another way to get exposure to the UK property market through indirect investment products.

Investors who do not want the commitment of a direct property ownership but who still want to invest in in the sector can consider a real estate investment trust (REIT). A REIT is a property investment firm that is listed on a stock exchange and aims to generate a return for shareholders and investors through earning a profit from its property portfolio. Today’s REITs have been around in the UK since 2007 and are good because they allow individual investors to invest indirectly in a diversified property portfolio, buying low cost and easily tradable units instead of having to finance the purchase of whole properties. They’re also tax efficient compared to other stock market investments and so if you don’t want to get your hands dirty but still benefit from growth in the property market, they’re worth looking at. But they do need to be understood properly and the fact that you can’t ‘see’ the underlying investments you’d be putting your hard earned cash into, you need to be a certain type of individual.

And to be honest, they leave me a bit cold. Despite the frustrations and arguments such as those I’d had over the past few weeks, owning something that you can touch and feel more than compensates for this. The ‘real’ nature of property as an investment medium is what I like about it. Armchairs are for old people and whilst I still have the energy and passion to invest in property directly, I’m not ready to put my power tools (or my Power Team) down just yet.

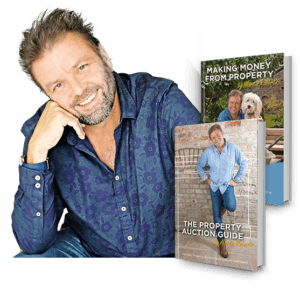

More information about REITs and other forms of indirect property investment can be found in my Making Money From Property Book – available on Amazon or at www.martinroberts.co.uk.